Important information for seniors Age amount – You can claim this amount if you were 65 years of age or older on December 31, 2013, and your net income is less than $80,256. The maximum amount you can claim is… {Read more}

Important information for seniors Age amount – You can claim this amount if you were 65 years of age or older on December 31, 2013, and your net income is less than $80,256. The maximum amount you can claim is… {Read more}

The Canada Revenue Agency (CRA) is taking action to stop various schemes used by people to claim unwarranted goods and services tax/harmonized sales tax (GST/HST) refunds. If you are thinking about participating in such a scheme, you should know that… {Read more}

The Canada Learning Bond (CLB) is part of the Canadian RESP program. Actually the CLB is a grant. The big difference between this grant and the regular RESP grants is that no contribution is required. Once you qualify, you apply,… {Read more}

If you think that paying for your employee’s disability premiums is always a good thing, think again. If you provide your employees disability as a nontaxable fringe benefit, payments they receive upon their disability will be, in most cases, FULLY… {Read more}

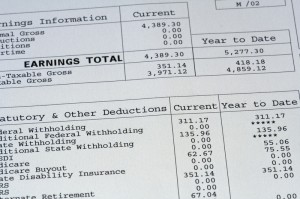

Employment income paid to an individual by an employer is reported based on the date it is paid, not earned. As an example, if a pay cheque dated in January covers income earned in the last days of December, that… {Read more}

Do you routinely use public transit? You might be eligible to claim a special tax credit for transit passes purchased in 2013 on your personal income tax return. The public transit tax credit is available for transit passes used in… {Read more}

Published by the CRA, Thursday April 10 at 3pm EST: The CRA continues to work on resolving the issue. In keeping with industry practice, we are currently implementing a solution, or “patch”, for the bug, and are vigorously testing all… {Read more}

Published by Canada Revenue Agency Wednesday April 9 at 3pm EST: The Canada Revenue Agency (CRA) places first priority on ensuring the confidentiality of taxpayer information. After learning late yesterday afternoon about the Internet security vulnerability named the Heartbleed Bug… {Read more}

You can claim eligible moving expenses if your new residence is at least 40 km (by the shortest public route) closer to your new place of work. These expenses are only deductible against the employment or self-employment income that you… {Read more}

Canada’s tax system is based on self-assessment. This means that individuals voluntarily complete an income tax return to report their annual income and claim all deductions or credits that apply to their situation. In this way, you are able to… {Read more}