The ceiling on the capital cost of passenger vehicles for capital cost allowance (CCA) purposes has increased from $30 000 to $34 000 (plus applicable federal and provincial sales taxes) for non-zero-emission vehicles and from $55 000 to $59 000… {Read more}

-

-

Year End Tax Planning Edition

It’s time to review some tax-planning opportunities that can be undertaken for the 2021 Tax Year.. Contribute to Your RRSP Contributions to RRSP’s are tax deductible and the income earned within the plan grows tax deferred until retirement. You can… {Read more}

-

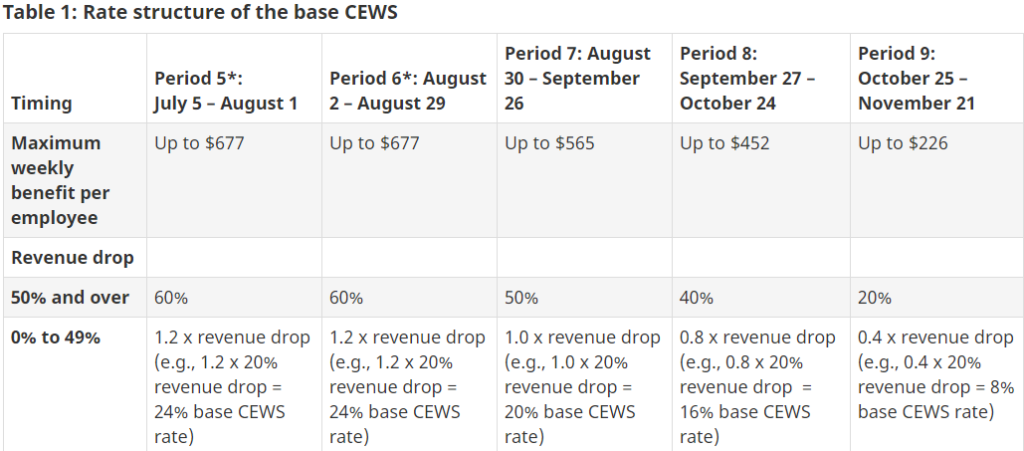

Canada Emergency Wage Subsidy – The New Program

Canada Emergency Wage Subsidy (“CEWS”) – The New Program RulesThe “old” CEWS program supported jobs by providing a reimbursement to employers for up to 75% of their employees’ wages, up to a maximum weekly limit of $847 per employee. The… {Read more}

-

Principal Residence Tax Reporting

Has your principal residence been sold recently? In 2016 an administrative change to CRA’s reporting requirements for the sale of a principal residence (PR) occurred. When you sell your PR or when you are considered to have sold it, usually… {Read more}

-

Salary Paid to a Family Member

Do you have salary paid to a family member? On one side, there is the question of the risk involved that the salary may be unreasonable and having the expense being disallowed. On the other side, there is the benefit… {Read more}

-

Voluntary disclosure

If you owe money to any of the tax authorities because you failed to file a return for one or more years, you can make a voluntary disclosure. You will pay only the tax due plus interest. No penalties will… {Read more}

-

Why You Need a Professional Tax Preparer for Your Business – 8 Points to Consider

Preparing income tax returns as a small business can be challenging. Tax laws change continuously, and keeping up with all of these filing requirements can be daunting for the busy business owner. In order to prevent tax-related problems, it is… {Read more}

-

Top things families should know about tax benefits, credits and deductions.

There are many benefits, credits, and deductions to help your family with expenses throughout the year and reduce the amount you owe at tax time. Child and family benefits Canada child tax benefit (CCTB) – You may be entitled to… {Read more}

-

Tax changes to expect when you’re expecting a baby

Congratulations! If you have a new baby or expecting a baby, there are plenty of credits and benefits you may be eligible to receive. Important facts Automated Benefits Application – Save time and paperwork! When registering the birth of your… {Read more}

-

Withholding Information from the CRA

Are you withholding information from the CRA? Will an auditor discover information online about activities that you have failed to report? If you run your own business or you are self-employed, you may be tempted to report only part of… {Read more}

Leave a comment

Leave a comment