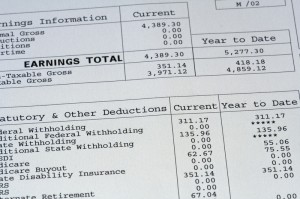

Employment income paid to an individual by an employer is reported based on the date it is paid, not earned. As an example, if a pay cheque dated in January covers income earned in the last days of December, that income must be reported on the T4 slip for the year that starts in January, since that is the year it was paid. Complete a T4 slip to report the following:

- salary, wages , severance pay, vacation pay;

- tips or gratuities, bonuses, commissions;

- taxable benefits or allowances;

- retiring allowances;

- director and management fees;

- deductions you withheld during the year; and

- pension adjustment (PA) amounts for employees who accrued a benefit for the year under your registered pension plan (RPP) or deferred profit sharing plan (DPSP).

You have to complete T4 slips for all individuals who received remuneration from you during the year if:

- you had to deduct CPP/QPP contributions, EI premiums, PPIP premiums, or income tax from the remuneration; or

- the remuneration was more than $500.

If you provide employees with taxable group term life insurance benefits, you always have to prepare T4 slips, even if the total of all remuneration paid in the calendar year is $500 or less.

Leave a comment

Leave a comment