If you have a website or a blog and you charge for advertising, links, or reviews, you must report the income on your Canadian income tax returns. Send invoices to your clients and customers. If your invoices exceed $30,000 in… {Read more}

If you have a website or a blog and you charge for advertising, links, or reviews, you must report the income on your Canadian income tax returns. Send invoices to your clients and customers. If your invoices exceed $30,000 in… {Read more}

As part of a continuing series of videos to help small business owners, the CRA has a video on getting started with payroll for your small business

The most common deductions that apply to students are moving expenses and child care expenses. Moving Expenses You can deduct moving expenses if you move to attend courses as a full-time student or if you moved to start a new… {Read more}

Ottawa, Ontario, March 7, 2014… The Canada Revenue Agency (CRA) warns all taxpayers to beware of telephone calls or emails that claim to be from the CRA but are not. These are phishing and other fraudulent scams that could result in… {Read more}

Press release from Government of Canada August 26th 2014 ) – Canada Revenue Agency The Honourable Kerry-Lynne D. Findlay, P.C., Q.C., M.P., Minister of National Revenue, joined by Peter Braid, Member of Parliament for Kitchener-Waterloo and Stephen Woodworth, Member of… {Read more}

The Canada Revenue Agency (CRA) encourages you to use its quick, easy, and secure electronic services to file your income tax and benefit return on time and pay any amount owing. You have until midnight on or before May 5,… {Read more}

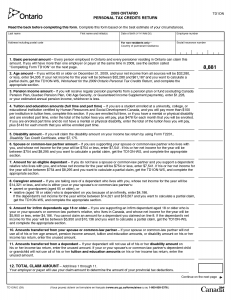

Did you know? If you owe tax at filing time each year, you can take steps to reduce your amount owing. You can do this by having tax or more tax deducted at source from certain types of income.td1-14e Important… {Read more}

Even if none of these requirements apply, you can file a return if any of the following situations apply: You want to claim a refund. You want to claim the WITB for 2013 You want to apply for the GST/HST… {Read more}

Press Release from the Canada Revenue Agency Toronto, Ontario, October 25, 2013 The Honourable Kerry-Lynne D. Findlay, P.C., Q.C., M.P., Minister of National Revenue, today met with business community leaders at a roundtable event in Toronto to highlight many of… {Read more}

Press release from Government of Canada March 20, 2014 – Winnipeg (Manitoba) – Canada Revenue Agency The Honourable Kerry-Lynne D. Findlay, P.C., Q.C., M.P., Minister of National Revenue, accompanied by Joyce Bateman, Member of Parliament, Winnipeg South Centre, today met… {Read more}