Did you know?

If you owe tax at filing time each year, you can take steps to reduce your amount owing. You can do this by having tax or more tax deducted at source from certain types of income.td1-14e

Important facts

- You can ask to have tax, or more tax, deducted at source from employment income, pension benefits from an employer-sponsored pension plan, and Old Age Security or Canada Pension Plan benefits.

- To have income tax deducted from Old Age Security or Canada Pension Plan benefits, send a completed Form ISP-3520, Request for Income Tax Deductions, to your Service Canada office. You can get this form online at www.servicecanada.gc.ca or by calling 1-800-277-9914.

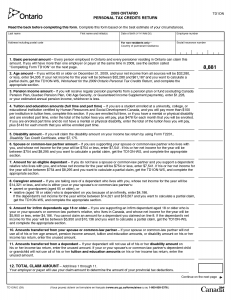

- To have tax withheld from employment income or from pension benefits from an employer sponsored pension plan, give a completed Form TD1, Personal Tax Credits Return, to your employer or pension plan administrator. You can get this form online at www.cra.gc.ca/forms or by calling 1-800-959-8281.

Leave a comment

Leave a comment