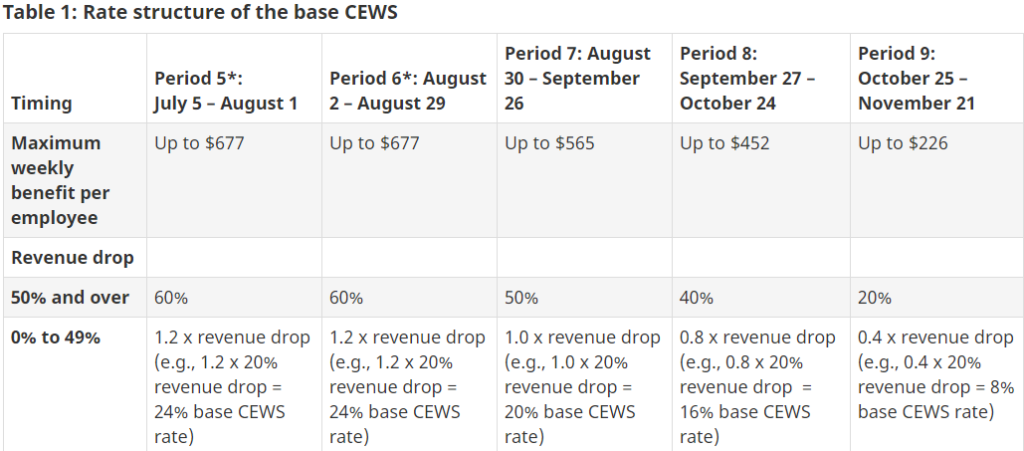

| Canada Emergency Wage Subsidy (“CEWS”) – The New Program Rules The “old” CEWS program supported jobs by providing a reimbursement to employers for up to 75% of their employees’ wages, up to a maximum weekly limit of $847 per employee. The program initially had 3 claim periods with the third period ending June 6th. The measure was extended for an additional 3 periods ending August 29th. When the Federal government announced the extension, they indicated that the 4th claim period, ending July 4th would be calculated in the same manner as the initial three claim periods. However, periods 5 and 6 were to be modified. On July 17th, the modifications were announced. The new program will make the subsidy accessible to a broader range of employers by including employers with a revenue decline of less than 30 per cent. However, the new program comes with increased complexity. It should be noted that at the time of this writing, the draft legislation has not passed into law. Furthermore, it is not possible to cover all the details of the new program in this 2-page newsletter, but here are a few highlights. 1. Program extension – the program was further extended from August 29th to December 19th. 2. Method choice – for periods 5 (ending August 1st) and 6 (ending August 29th) employers will have the option to calculate the wage subsidy under either the old rules or the new rules. 3. New method – will be obligatory for periods 7 through 9 (ending Nov 21). No rules have been provided yet for the last period ending December 19th. 4. Eligible salaries – for arm’s length employees will be the amount paid in respect of the new periods. It will not consider the pre-crisis remuneration paid in January and February 2020. There are separate rules for non-arm’s length employees. 5. Two-tiered program – Base subsidy – available to all eligible employers that are experiencing a decline in revenues, with the subsidy amount varying depending on the scale of revenue decline; and – Top up subsidy – of up to an additional 25 per cent for those employers that have been most adversely affected by the COVID-19 crisis. Generally, an eligible employer’s top-up would be determined based on the revenue drop experienced when comparing revenues in the preceding 3 months to the same months in the prior year, or alternatively, compared to January and February 2020. 6. The new program rates for the base subsidy are best described in a table format, reproduced from the government documents (see following page). Note that the base subsidy is gradually reduced over the claim periods and that the table does not include the rates for the top up subsidy. |

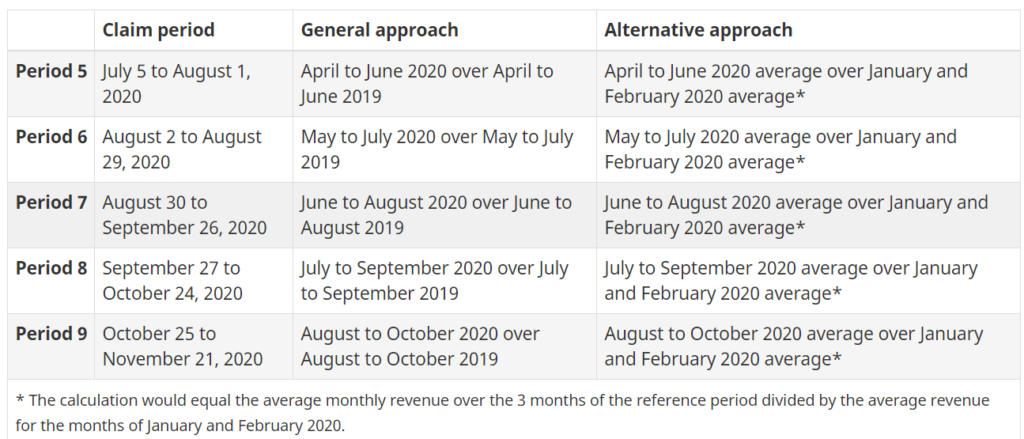

The decline in revenue test remains the same for the base subsidy as it did under the previous program but with more flexibility – there is now a choice as to which period is used as a comparison (year-over-year method or the Jan/Feb 2020 average) regardless of the method used for the previous four periods. However, to benefit from the top-up subsidy, a new revenue decline test will be calculated based on the prior three-month period or alternatively compared to the average sales for January and February 2020, as shown in the table below.

Leave a comment

Leave a comment